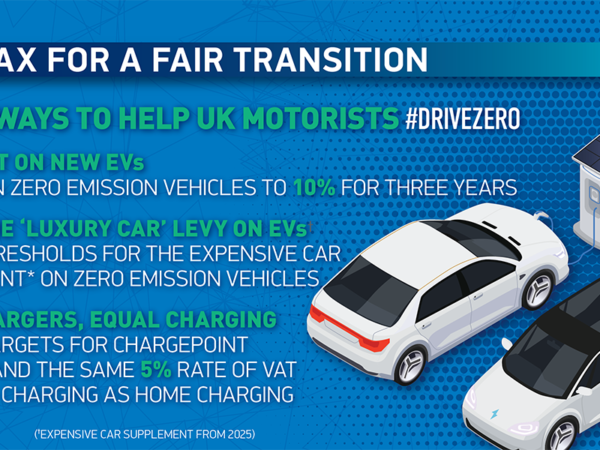

SMMT calls for ‘Fair taxes for a fairer transition’

The automotive industry is calling for the UK’s chancellor to use the upcoming Budget to put the UK’s shift to electric vehicles back in the fast lane, with fair taxes for a fairer transition. New research commissioned by the Society of Motor Manufacturers and Traders (SMMT) from Savanta has revealed that rising numbers of would-be EV drivers are now likely to delay their switch to a battery electric car – but a three-point plan of tax reform would recharge the market and accelerate the UK’s progress towards net zero.

SMMT

SMMT

Tumisu; Pixabay

Tumisu; Pixabay Chris McAndrew

Chris McAndrew Deva Darshan; Pexels

Deva Darshan; Pexels