Ongoing shift to high-value tyres behind first-half profit increase at Pirelli

(Source: Pirelli)

(Source: Pirelli)

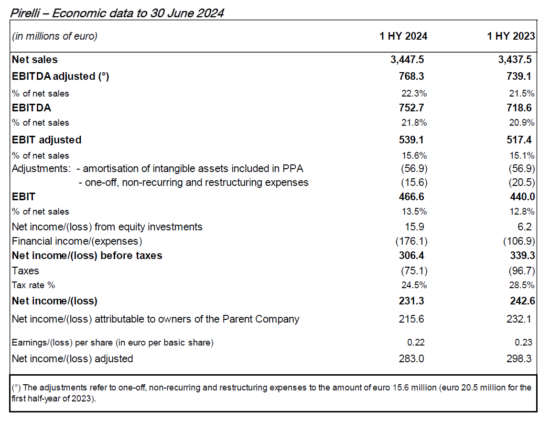

Pirelli reports “stable” sales of 3,447.5 million euros in the first half of 2024 (First-half 2023: 3,437.5 million euros). Adjusted pre-tax profits (EBIT) amounted to 539.1 million up 4.2 per cent compared with first half of 2023. Executives put the improvement down to “solid commercial performance (volumes and price/mix)” and “efficiencies”.

Meanwhile, company which is known for high performance products, further strengthened the proportion of “high-value tyres” it sold in the period. “High-value tyres”, a term that generally refers to >18-inch rim diameter and 4×4/SUV tyres, now account for 77 per cent of sales, compared with 74 per cent in the first half 2023.

As a result, Pirelli’s adjusted EBIT margin rose to 15.8 per cent (Q2 2023: 15.5%), something that prompted Pirelli to raise its full-year targets. Pirelli is now aiming for full-year sales of 6.6 to 6.8 billion euros and volume increases of around 1.5 per cent to 2.5 per cent. Adjusted EBIT Margin is expected at about 15.5 per cent, the top end of previous guidance.

In Car ≥18” volume growth was 7 per cent compared with a market increase of 6 per cent. Broken down by channel, Pirelli volumes grew 10 per cent compared with market growth of 9 per cent in replacement; and 3 per cent compared with 2 per cent in Original Equipment.

Continuing OE strength

In the first half of 2024, Pirelli obtained around 150 new homologations with “the main Premium and Prestige car makers, mainly in rim sizes ≥19” and Specialties”. In the electric vehicle segment, Pirelli has a portfolio of around 700 homologations at the global level and market share in Original Equipment of 30 per cent. The company also continues to obtain homologations with the leading Premium Chinese producers of electric vehicles. That’s significant because Chinese OE market share has shifted back in favour of domestic tyremakers in recent years after years of leadership from global brands. In other words, ongoing Chinese OE market growth for Pirelli means the Italian tyremaker is performance against the trend in that respect.

Pirelli expects the global car tyre market in 2024 to be “flat” year-on-year, compared with the growth of around 1 per cent estimated in May. The change is said to be due to “the greater weakness in the standard segment, which is expected to be -1 per cent the previous estimate of +1 per cent to flat.

High Value tyres are confirmed as the most resilient segment, with growth estimate of “mid-single digit” levels and about 7 percentage points higher compared with the expected performance of Standard.

Original Equipment volumes are expected to grow at “mid-single Asia-Pacific area.

Comments