Fuel purchasing shows discretionary spending’s up almost 9%

Discretionary spending could be up by the best part of 9 per cent, according to data which compared the decrease in fuel costs with increase in total fuel sales to consumers. The latest Verum Financial Research Household Discretionary Spending Tracker, reached its conclusion by subtracting essential living costs from total household spending. The result was an 8.7 per cent year-on-year increase in UK household discretionary spending during the third quarter of 2014 – its fastest rate for over 15 years. The analysis was based on quarterly data published by the Office for National Statistics (ONS) on UK household spending.

While spending increased on a wide range of products (cars, air travel, hotels, restaurants, alcoholic drinks, major household appliances and cinema and outdoor entertainment), Verum suggests that the most significant trend was the increased spending on petrol and diesel.

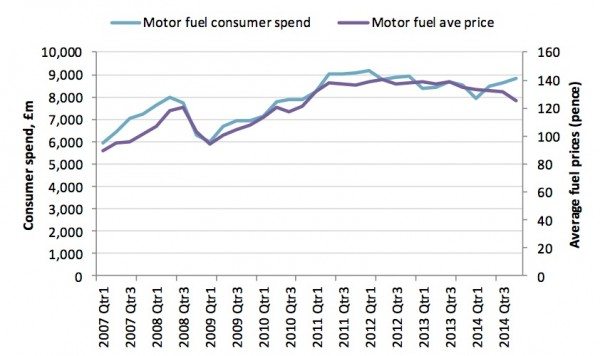

Between July 2008, when a barrel of Brent crude reached a peak spot price of $144, and the first quarter of 2014, UK household spending on motor fuel mirrored changes in the price of fuel. Despite changes in price, the volume of fuel that households bought remained virtually unchanged. Hence, when pump prices rose, spending on motor fuel rose. When pump prices fell, spending on motor fuel fell.

This relationship appeared to change in Q2 2014. Pump prices fell by less than 1 per cent but household spending on motor fuels increased by over 6 per cent. The question Verum raises is: Is this a sign of sustainable economic recovery? And Tyres & Accessories readers will know that this is a question that we too have been asking in our January and February issue.

Further spending increases on the horizon

For his part, Robert Macnab, director of research at Verum, which carried out the analysis, said: “Having followed the average fuel price so closely for so long, the sharp rise in consumer spending on fuel from April 2014 onwards is an intriguing development. Remember, it was a rise in oil and fuel prices which caused household discretionary spending to contract in 2008/09 and tipped the UK economy into recession.

“If the recent higher spending on motor fuel is sustained, we can expect an acceleration in economic activity over the coming weeks and months. It is not the increase in fuel spending itself that is significant, rather what it represents. Families are doing more miles and they are travelling to spend, whether that is on shopping, eating out, going to the cinema or visiting friends. If this behaviour spreads, it will have a positive multiplier effect on the UK economy.”

There could also be implications for the fleet market and by implication the fleet tyre market too: “Lower fuel prices will also encourage companies to use their vehicles more, resulting in an increase in business activity, while transportation costs for many products will fall as well”, Macnab continued:

“Looking at the trend in more detail, it is important to note that pump prices had started to fall in Q4 2013, so there was a lag effect. Once households realised that lower fuel prices were sustainable, and might fall even further, they began to spend more on fuel. Q2 2014 therefore saw a step change in the fuel-price and fuel-demand relationship.

“Some economists and investors have voiced concerns that the recent oil price falls mean that global demand may be weakening. However, this latest UK data suggests that lower fuel prices are stimulating an increase in spending, particularly among households.”

In other words the conclusion is that there appears to be a growing perception among households that we have finally turned the corner economically.

Compared side-by-side it increasingly clear that fuel costs and fuel spending are diverging, meaning consumers confidence is up – as are disposable incomes. Source: Verum, ONS

Comments