Port congestion sees shipping rates increase – MCS

Freight rates stabilised in November after an earlier than anticipated peak

Freight rates stabilised in November after an earlier than anticipated peak

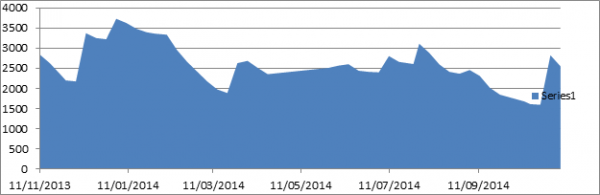

Increases in freight rates during the last quarter of the year happened earlier than expected, according to Maritime Cargo Services’ Rob Shelley. The freight forwarding company said that the market, led by supply and demand, had seen rates harden due to increased demand for shipping space “earlier than expected”. This ahead of schedule peak season combined with “higher than forecast import volumes” to increase both rates – “in some cases by 150 per cent” – and dockside waiting times.

Of the latter, Shelley added that congestion at UK ports caused by a shortage of HGV drivers had been an issue.

“There has been a period of severe congestion at UK ports, specifically Felixstowe, Southampton and London Gateway this year. Some lines were specifying a week’s notice on container collections; others capitalised by increasing haulage rates and advising customers to prepare for substantial delays to imported containers.

“Of the factors that were behind the constipation, the most significant is a national shortage of HGV drivers. Implementation of the new Driver Professional Competence (CPC) scheme featuring periodic training at a cost of £3,000 is resulting in some older drivers choosing early retirement while younger drivers struggle to fund the investment. According to the Road Transport Association, the industry is facing a 40,000 driver shortfall in the run up to Christmas.”

While these factors clearly remain problematic, Shelley told Tyres & Accessories that there is a “prospect of a two tier shipping service”, after the Chinese government nixed the proposed P3 Alliance between Denmark’s Maersk, Mediterranean Shipping Company (MSC) from Switzerland and French company CMA CGM over what it termed “monopoly concerns”.

“The other thing that reduces price is public holidays both in China and Europe,” Shelley continued. The rate began to drop again in November after an early high, since there is less demand for arrivals in last two weeks of December.

Overall, Shelley summarised at the end of November that rates were “pretty stable around the $2,500 level per 40’HC.”

Comments