Goodyear reports net loss of $57 million in Q1 2024 figures

While Goodyear reported a net loss of $57 million in the first quarter of 2024, other metrics suggest that the company’s financial situation is offering signs of improvement. A strong showing from the Asia Pacific region and the welcome “stabilisation” of truck tyre demand in EMEA were both notable examples of improvement alongside the impact of Goodyear’s well-documented Goodyear Forward transformation plan.

Goodyear’s first quarter 2024 sales were $4.5 billion with tyre unit volumes totalling 40.4 million. It is also worth noting that Goodyear’s first quarter 2024 net loss of $57 million compared to a net loss of $101 million a year ago. And this comes in spite of Goodyear Forward costs of $28 million and rationalization charges of $22 million, which, in total, are higher than pre-tax rationalization charges of $32 million in 2023.

According to Goodyear executives, the increase in segment operating income reflects benefits of $127 million from price/mix versus raw materials and $72 million from the Goodyear Forward transformation plan. These were partly offset by the impact of net inflationary costs of $33 million and lower tyre volume of $28 million.

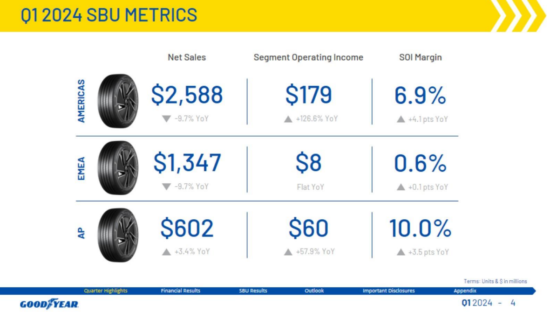

Arguably the clearest insights into Goodyear’s recent progress can be seen at the strategic business unit or SBU level. When you compare Goodyear’s business in the Americas with its EMEA and Asia Pacific regions, it is immediately obvious that net sales are still somewhat undesirable. Americas’ first quarter 2024 sales of $2.6 billion were down 9.7 per cent compared with 2023 “driven by lower replacement volumes and unfavourable price/mix due to continuing industry weakness in commercial truck and contractual price adjustments.” At the same time, Americas “tyre unit volume decreased 7.4 per cent” and replacement tyre unit volume decreased 9.2 per cent due to increased sales of lower cost imports.

EMEA’s first quarter 2024 sales of $1.3 billion were also down 9.7 per cent for much the same reasons while Asia Pacific was the only region to register increases, with sales up 3.4 per cent year-on-year to US$602 million “driven by higher original equipment volume”. Here tyre volumes increased 10.0 per cent. Dig a little deeper and you learn that this figure is driven by EV original equipment volumes which were up 26.7 per cent in China. Even in the comparatively booming Asia Pacific region, replacement tyre unit volume decreased 1.6 per cent. In other words, Goodyear has improved the efficiency of its operations and the profitability of what it sells, but – some nice Asian market exceptions aside – is not selling more tyres.

Will Goodyear forward help EMEA?

The presentation was led by Mark Stewart, Goodyear’s recently appointed chief executive officer and president and Christina Zamarro, the company’s executive vice president and chief financial officer. When it came to the question and answer part of the conference call they sought to add further detail relating to both the demand environment and the relative successes of Goodyear Forward.

“We don’t have evidence of a consumer trade-down, especially [among] tier one consumers…” Christina Zamarro commented, adding the caution that “more recently we have seen some [downward] movement in tier two to tier four”. However, Zamarro also questioned whether such movement was as much about distributor behaviour as it is about consumer demand.

Will Goodyear Forward impact EMEA and, if so, when? “70 per cent of Goodyear Forward benefits Americas”, while the remainder is split between EMEA and the Asia Pacific region. To be specific, the circa $370 million expected improvements from Goodyear Forward will result in something like $259 million of benefits to the Americas region during 2024. And the remaining $111 million will be split between the Asia Pacific region and EMEA.

Comments