Goodyear lost $291 million in Q4 2023, but EMEA improvements

fourth-quarter 2023 financial results summary (Source: Goodyear)

fourth-quarter 2023 financial results summary (Source: Goodyear)

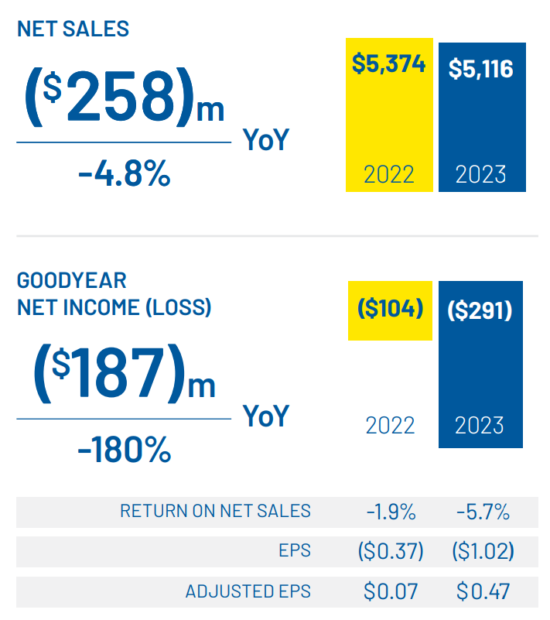

Goodyear’s fourth-quarter 2023 sales decreased 4.8 per cent compared to the previous year driven by “the impact of lower replacement volume and lower third-party chemical sales”. That and other factors resulted in a fourth-quarter 2023 net loss of $291 million compared to a net loss of $104 million – 180 per cent worse than the figure a year ago.

Comments closed

Comments