Volume and price-mix performance current keys to success of premium tyre brands

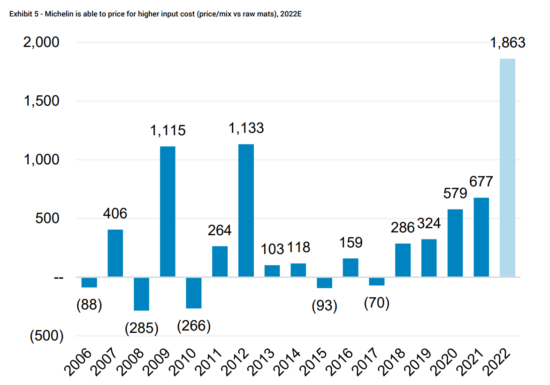

Michelin’s long-term price-mix performance compared to raw material costs (Chart: Jefferies)

Michelin’s long-term price-mix performance compared to raw material costs (Chart: Jefferies)

Michelin’s third-quarter 2022 sales outperformed consensus expectations by 3.9 per cent. Sharing its third-quarter 2022 financial results, Michelin confirmed its full-year 2022 adjusted pre-tax profit (EBIT) guidance, but it also reduced its free-cash-flow expectations by 0.5 billion euros. But much of the company’s relative success depends on its strong price-mix performance, a factor that is equally important to other premium tyre brands. Here, Tyres & Accessories reads Michelin’s recent third-quarter 2022 financial results in light of the consensus expectations and a recent investor’s note published by Jefferies.

Michelin’s third-quarter 2022 sales rose 23.8 per cent in the period to €7,443 million (+13.7% organic) compared with consensus expectations of €7,164 million and therefore a +3.9 per cent outperformance. As a result, certain analysts were pleased with the results. Reiterating their “buy” rating, Jefferies analysts wrote: “We update our estimates to incorporate these and some caution on volumes. We cut our full-year 2023-2024 estimates modestly and remain slightly above consensus. We continue to like Michelin due to its price discipline and attractive valuation – trading near trough multiples and at circa 20 per cent discount to its global peers.”

Michelin’s sales were driven by a price-mix improvement 14.9 per cent compared with the third quarter of 2021. Again, this outperformed consensus expectations, which came in at +12.4 per cent. But that good news was partly offset by volume declines of -2.6 per cent, which were worse that the -1.6 per cent consensus projection.

Jefferies analysts calculated that car tyre volumes were down circa 5 per cent in the third-quarter partly due to the exit from Russia. However, there was also caution that some underperformance was due to Asian imports and truck tyre volumes also being down 1 per cent. Nevertheless, as with other tyre manufacturers, the speciality segment bucked the turbulent general market trend and was up 1.4 per cent.

Looking forward, Michelin confirmed that the market outlook for car tyre volumes sits in the -2 per cent to +2 per cent range. Meanwhile, truck tyre volumes are expected to grow 2-6 per cent in markets outside China. And, while the speciality segment has been a perennial safe-haven, volume growth was downgraded from 3-7 per cent to 4-8 per cent.

On the subject of full-year 2022 projections, Michelin adjusted its volume guidance to growing “below market” compared with “in line with the market” before. The reason? Michelin’s focus on high-value segment and margin.

For their part, Jefferies said they expect fourth-quarter volumes to decline -5.3 per cent and -3.2 per cent in full-year 2022 figures, adding: “We forecast full-year 2022 sales/EBIT/margin of 28.1 billion euros/3,401 million euros/12.1 per cent [respectively]…We are cautious on volumes and expect net Price-Mix to offset cost inflation”.

As well as volumes, de-segmentisation is a not unexpected pressure on premium manufacturers including Michelin, with Jefferies noting:

“Michelin highlighted trading down in Tier 2/3 brands across regions but does not yet see it in Tier 1 brands. Management also stressed that its pricing strategy remains unchanged, input cost inflation (including non raw mats) will be passed on to end customers. Into 2023, we build in some caution on Michelin volumes as we expect ML to likely underperform the market due to its price discipline and premium pricing.”

Bridgestone

Bridgestone

Comments