UK car production falls 14.2 per cent in 2019

Source: SMMT

Source: SMMT

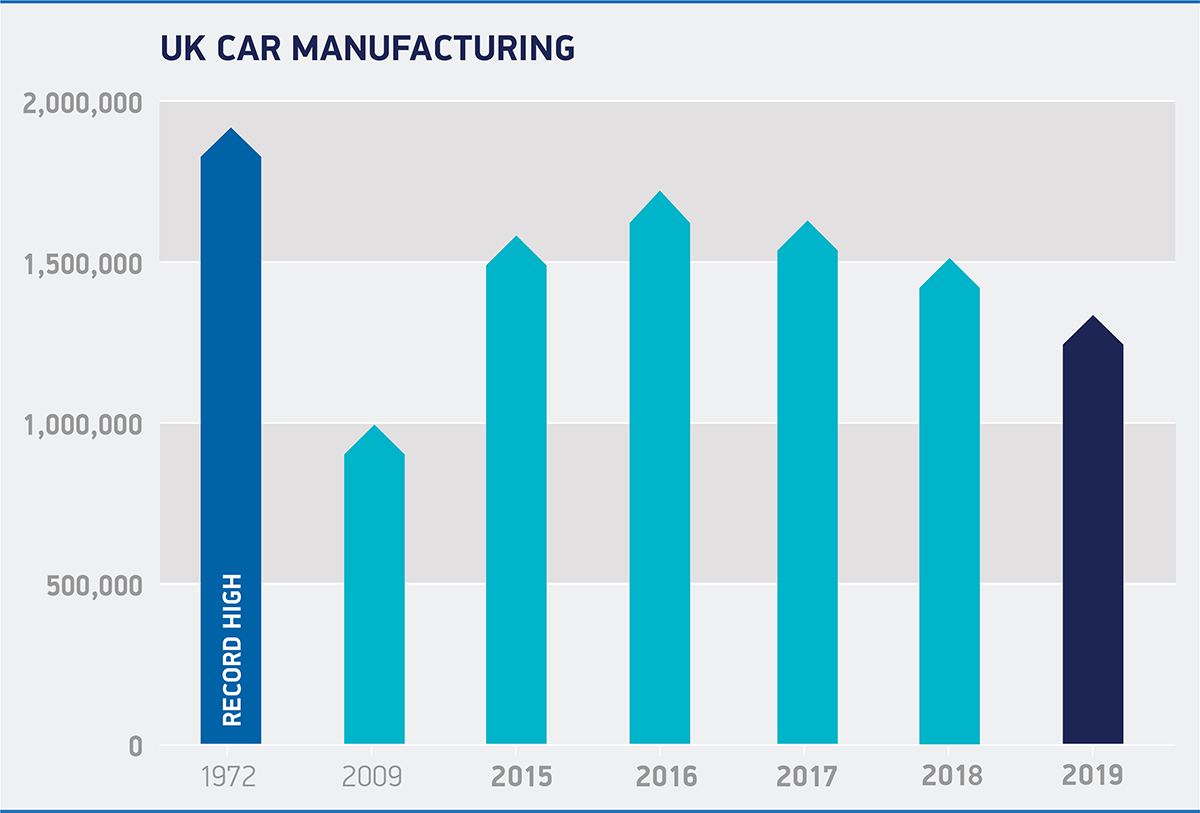

UK car production fell -14.2 per cent in 2019, to 1,303,135 units, according to figures released by the Society of Motor Manufacturers and Traders (SMMT), with a -6.4 per cent drop in December rounding off a third year of decline. Output was affected by multiple factors, including weakened consumer and business confidence at home, slower demand in key overseas markets, a number of significant model production changes and a shift from diesel across Europe. Factory shutdowns in the spring and autumn, timed to mitigate expected disruption arising from the anticipated departure of the UK from the EU on 29 March and 31 October, also had a marked effect.

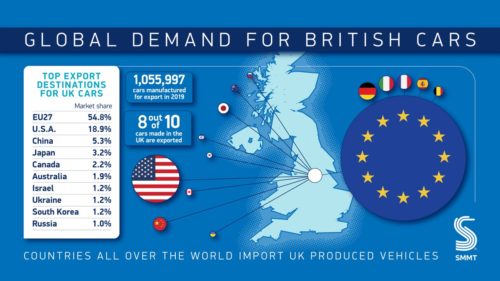

Manufacturing for domestic car buyers fell -12.3 per cent, to 247,138 units, while exports also took a hit, down -14.7 per cent, although overseas orders continued to drive volumes, accounting for more than eight in 10 cars built and totalling over one million units. Although shipments to the EU27 fell, by -11.1 per cent, the bloc remains the sector’s most important market with its share of exports rising by two percentage points to 54.8 per cent. Meanwhile, trade with the UK’s next largest markets, the US (representing 18.9 per cent of export volumes), China (5.3 per cent) and Japan (3.2 per cent) also fell, with exports down -9.8 per cent, -26.4 per cent and -17.7 per cent respectively.

The UK’s renowned small volume car manufacturing sector, however, bucked the trend with growing demand for some of the world’s most iconic and desirable brands boosting output by 16.2 per cent in the year. Meanwhile, production of alternatively fuelled cars rose, by 34.7 per cent to 192,304 units, as global appetite for the UK’s electric, plug-in hybrid and hybrid offering continues to rise. Thanks to its engineering excellence, expertise in advanced powertrain technologies, light-weighting and aerodynamics, the UK is well-placed to lead the charge in ultra-low and zero emission vehicle development and manufacturing – if the right business conditions are in place.

Last year saw £1.10 billion of fresh automotive investment publicly announced for the UK. The bulk of that investment, however, was from one company looking to expand electric vehicle production in the West Midlands. With 2019’s investment tally some 60 per cent lower than the £2.75 billion averaged over the previous seven years, it’s clear that more must be done to encourage overseas investors to follow suit.

Source: SMMT

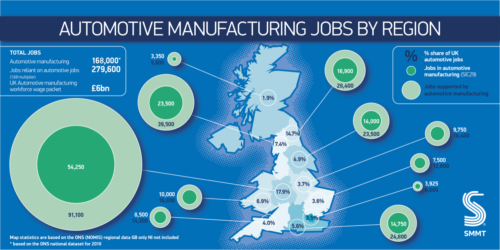

The news comes as SMMT reveals new figures highlighting the critical contribution of UK Automotive to regions right across Britain. One in 14 people (168,000) employed in manufacturing nationwide works in Automotive, with an additional 279,000 jobs supported, while in regions such as the North East and West Midlands, automotive accounts for more than one in six manufacturing jobs. With annual salaries typically 21 per cent higher than the average across all UK employment, Automotive’s combined national salary contribution amounts to some £6 billion.

Mike Hawes, SMMT chief executive, said: “The fall of UK car manufacturing to its lowest level in almost a decade is of grave concern. Every country in the world wants a successful automotive sector as it is a driver of trade, productivity and jobs.

“Given the uncertainty the sector has experienced, it is essential we re-establish our global competitiveness and that starts with an ambitious free trade agreement with Europe, one that guarantees all automotive products can be bought and sold without tariffs or additional burdens.

This will boost manufacturing, avoid costly price rises and maintain choice for UK consumers. Negotiations will be challenging but all sides stand to gain and this sector is up for it.

“Meanwhile, the latest independent production outlook downgrades expectations for 2020 to 1.27 million units, down from the 1.32 million forecast made in November. To arrest this decline and ensure the future competiveness and success of UK automotive manufacturing, negotiations on the future UK-EU relationship – and trade deals with the rest of the world – must move quickly and deliver for this critical sector.”

Analysts’ comments on 2019 car manufacturing figures

Commenting on the SMMT figures, Justin Benson, head of automotive at KPMG, said: “The UK’s car production numbers are worrying, particularly as most of the vehicles manufactured in automotive are exported. Global pressures are softening demand as much as recent local factors. The silver lining in the UK, however, is commercial vehicles, and particularly electric commercial vehicles.

“For the industry the UK is a centre of excellence, and investment for low/zero emission vehicles is increasing rapidly. Fully battery electric vehicle sales were up nearly 125 per cent in 2019, and whilst the transition is difficult, the UK is a great place to invest in the opportunities ahead.”

David Leggett, automotive editor at leading data and analytics company, GlobalData, called for stabilisation: “Last year was clearly a difficult one for the UK’s automotive industry. There were pressures at home with the UK car market in decline, but lower shipments to major export markets is more of a concern for manufacturers such as Jaguar Land Rover.

“The US accounts for almost a fifth of UK car exports, and shipments to the US were down by almost 10 per cent last year. China accounts for a smaller proportion of UK car exports, but it is the world’s largest car market and seen as a strong long-term growth opportunity. However, shipments of UK-made cars to China were down by a hefty 26 per cent last year.

“As far as 2020 goes, there are continued challenges ahead. The US will remain a difficult car market with overall demand flat or slightly declining. China, too, will be a tough market as its economy will continue to slow (not helped by the coronavirus crisis which will dent it further).

“UK car manufacturers are hoping that negotiations between the UK and EU regarding a permanent future trading relationship will go smoothly to secure tariff-free trade-in vehicles, as well as no additional burdens or costs. With almost 55 per cent of the UK’s total car export shipments heading for the EU27 – by far the largest export market destination – the competitive implications of any disruption to those trade flows, for parts as well as vehicles, are stark.

“The UK’s automotive sector needs to continue to secure increased investment, especially in emerging key technology areas such as electrification – something that will be helped by keeping the overall level of car manufacturing activity stable and by maintaining confidence.”

Source: SMMT

Comments