UK car production a factor in lower Q3 2018 volumes for Superior Industries Inc.

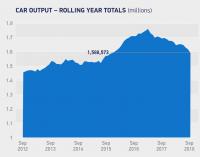

Declining car production in the UK has contributed towards lower wheel unit shipments in the third quarter of 2018, reports Superior Industries International, Inc. Compared with the prior-year period, Q3 2018 shipments were down 300,000 units to 4.7 million.

“Our preliminary third quarter 2018 results reflect the impact of the Worldwide Harmonized Light Vehicle Test Procedure (WLTP) emission standards, which drove lower volumes due to reduced OEM production throughout Europe, as well as softer production schedules from our OEM customers in the United Kingdom,” commented Don Stebbins, president and chief executive officer of Superior Industries International. Uniwheels supplies numerous vehicle plants in the UK. Sales to Jaguar Land Rover, for example, accounted for two per cent of Superior’s global sales in the first half of 2018, and conditions that have let to the current temporary closure of the vehicle manufacturer’s Solihull plant have impacted upon unit shipments from Superior.

“Additionally, rising energy rates in Mexico, coupled with higher launch costs associated with our newer sophisticated designs and finishes in North America and Europe negatively impacted the quarter. These factors will continue to pressure profitability during the fourth quarter,” Stebbins added. “While we remain confident in the long-term opportunities ahead for the company, we are revising our 2018 full year outlook.”

Comparative preliminary results for the third quarter of 2018 were impacted by the inclusion of one additional calendar week of North America operations in the third quarter of 2017 as a result of the realignment of the fiscal periods to calendar quarters in 2017.

Net sales for the third quarter of 2018 are expected to be in the range of US$345 million to $350 million, compared to net sales of $331.4 million in the third quarter of 2017.

Value-added sales for the third quarter of 2018 are expected to be in the range of $175 million to $180 million, compared to value-added sales of $187.4 million in the third quarter of 2017.

Adjusted EBITDA is expected to be approximately $30 million for the third quarter of 2018, compared to $43.0 million in the third quarter of 2017.

These financial results are preliminary, and therefore subject to Superior’s completion of its customary quarterly closing and review procedures. Complete financial results for the quarter ended 30 September 2018 will be released on 9 November 2018.

For the full 2018 fiscal year, Superior now expects unit shipments to be in the range of 20.85 million to 21.05 million, lower than previous projection of 21.25 million to 21.60 million units.

Net sales are expected to be in the range of $1.48 billion to $1.51 billion, down from the previous projection of $1.52 billion to $1.56 billion.

Value-added sales are also now expected to be lower than previously anticipated, in the range of $790 million to $805 million rather than $800 million to $835 million.

Adjusted EBITDA is now expected to be between $175 million and $180 million rather than the previously-announced projection of $190 million and $205 million.

Comments