Bridgestone Q3 results – sales and profit up

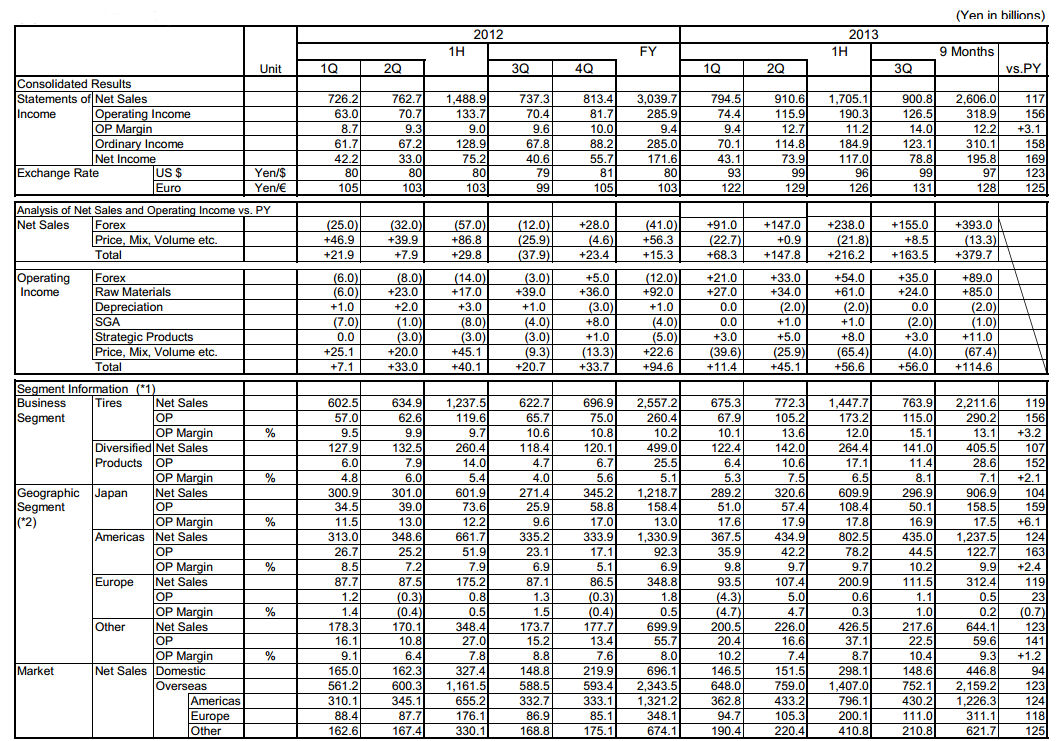

In its consolidated financial statements for the first three quarters of the 2013 fiscal year, Bridgestone Corporation reports net sales of ¥2,606.0 billion (£16.4 billion) between January and September, a 17 per cent increase from the first three quarters of 2012. Net sales in the third quarter alone were ¥900.8 billion (£5.7 billion). Operating income amounted to ¥318.9 billion (£2.0 billion) for the first nine months of the year, a year-on-year increase of 56 per cent, and ¥126.5 billion (£797.9 million) in the third quarter. Margins for the two periods were 12.2 per cent and 14.0 per cent, respectively. Ordinary income between January and September was ¥310.1 billion (£2.0 billion), an increase of 58 per cent, and ¥123.1 billion (£776.4 million) in the third quarter. Net income in the first nine months of the year rose 69 per cent to ¥195.8 billion (£1.2 billion), while it was ¥78.8 billion (£497.0 million) in the third quarter.

The company’s tyre segment achieved sales of ¥2,211.6 billion (£13.9 billion) in the first nine months of the year, 19 per cent higher than during the same period last year, and sales of ¥763.9 billion (£4.8 billion) in the third quarter. Segment operating income was ¥290.2 billion (£1.8 billion) for the first three quarters of fiscal 2013, up 56 per cent year-on-year, and ¥115.0 billion (£725.3 million) in the third quarter alone.

In Europe, unit sales of passenger car and light truck tyres decreased compared to the first three quarters of fiscal 2012, while unit sales of truck and bus tyres increased strongly due to an increase in replacement market tyres. European net sales of both tyres and diversified products amounted to ¥312.4 billion (£2.0 billion) in the first nine months of the year, a year-on-year increase of 19 per cent, and ¥111.5 billion (£703.3 million) in the third quarter. Nine-month and third quarter operating profits and margins were ¥500 million (£3.2 million) and ¥1.1 billion (£6.9 million), and 0.2 per cent and 1.0 per cent respectively. Commenting on the market environment encountered in Europe during the first nine months of the year, Bridgestone wrote on 7 November that “although the European economy has shown signs that it had bottomed out, it remained stagnant.”

In an initial impression of the results, analyst Kurt Sanger from DB Equity Research Automotive commented that although Bridgestone’s operating profit was “inflated by an accounting issue” in the third quarter, the company’s core results were still “incrementally positive” in comparison with Deutsche Bank estimates. “The vibe was certainly better than other recent global tyre majors on mining tyres and overall pricing trends,” opined Sanger. He added that although the implied fourth quarter operating profit, at ¥80 billion (£504.6 million), is “weak”, DB Equity Research expects the market to see this as “simply a lack of change in the company full-year forecast.”

Comments