PSA acquires Opel/Vauxhall

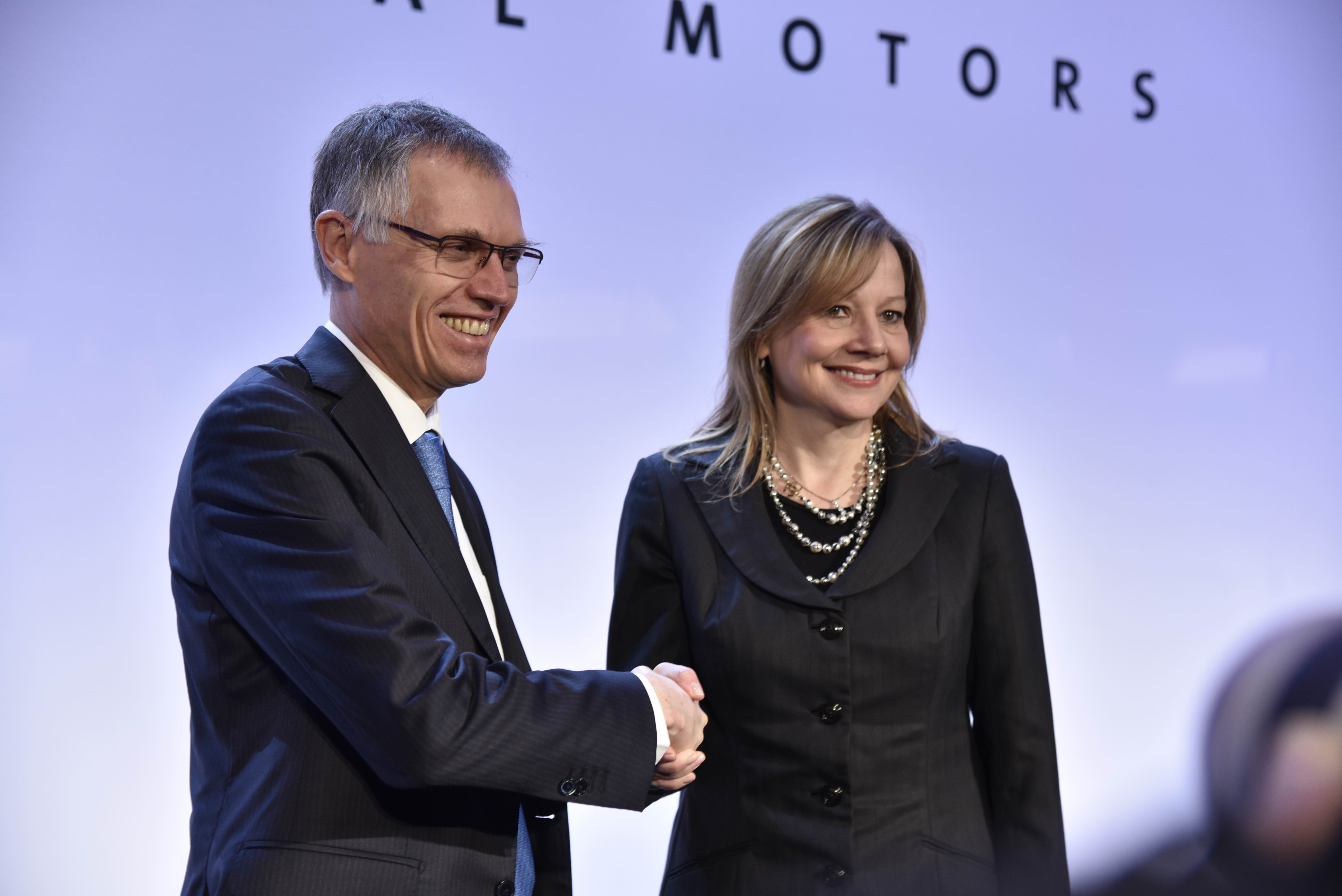

PSA’s Carlos Tavares and GM head Mary Barra announced the acquisition at a press conference in Paris on 6 March 2017

PSA’s Carlos Tavares and GM head Mary Barra announced the acquisition at a press conference in Paris on 6 March 2017

In a deal designed to make PSA Group the second largest carmaker in Europe, the Peugeot-Citreon brand owner has bought GM’s long-term lossmaking Opel and Vauxhall brands and production bases for 2.2 billion euros. This figure includes a joint venture with BNP Paribas on the GM Europe auto financing operations (valuing these transactions at 1.3 billion euros and 0.9 billion, respectively). But what does it mean for the tyre sector?

Comments closed

Comments