On the up? Pricing trends in the UK car tyre aftermarket

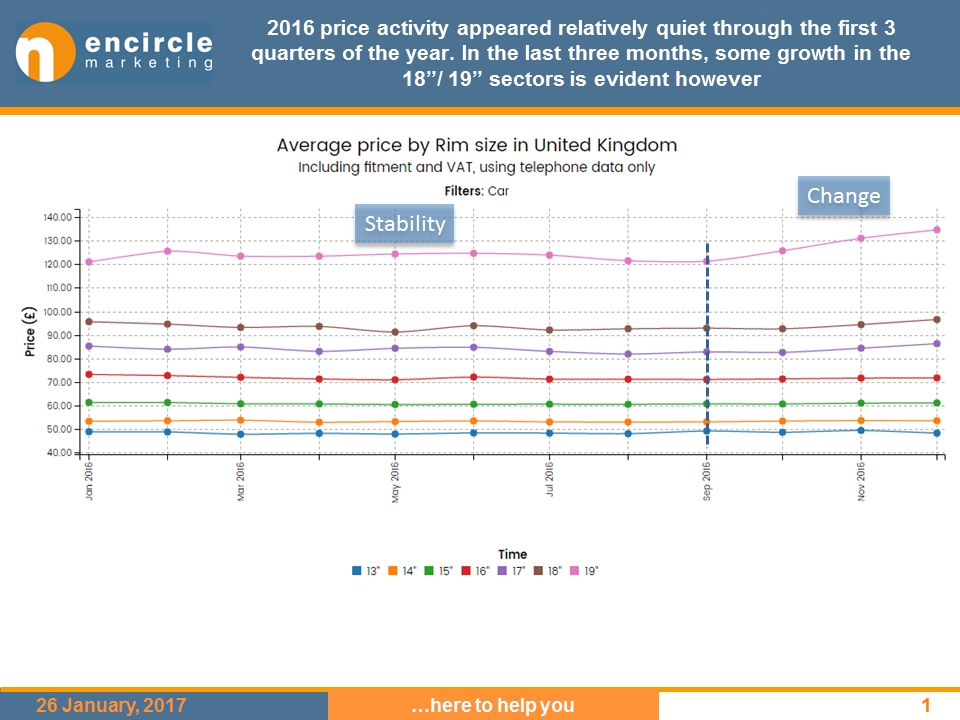

With raw material prices reaching the sky-rocket part of their lifecycle, as well as realisation by some Chinese tyremakers that unrealistically low prices can’t go on forever, all in the presence of the now ubiquitous post-Brexit vote uncertainty, many industry observers have suggested that tyre prices – including those for passenger car applications – are likely to rise during 2017. Tyres & Accessories spoke with Encircle Marketing’s resident industry analysts David Myers and Jason Cunningham in order to find out more.

Comments closed

Comments