Vacu-Lug manufacturing investment, contracts a way forward in contracted UK market

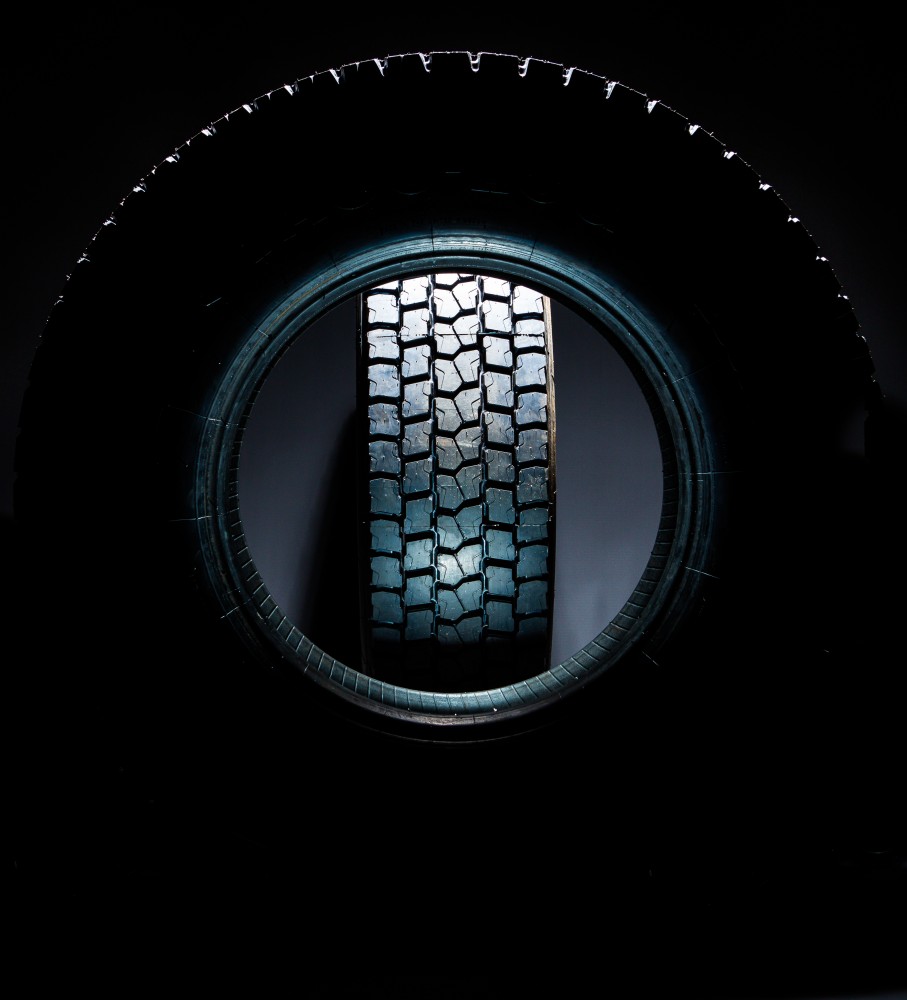

The retreader has continued to invest in its manufacturing processes, including a second 12-segment, high pressure (300psi) press on which its Logistik brand products are produced

The retreader has continued to invest in its manufacturing processes, including a second 12-segment, high pressure (300psi) press on which its Logistik brand products are produced

Vacu-Lug’s stand at the recent Commercial Vehicle Show in Birmingham provided a summary of the tripartite business of one of the UK’s largest retreaders. Featuring its Vacu-Lug Management System (VMS) for online fleet application; its UK exclusive distribution of ZC Rubber’s (or Hangzhou Zhongce’s) Westlake truck tyre product range. in partnership with global Westlake partner Zenises; and Vacu-Lug’s own retread range – including the latest “premium” Logistik drive LD01 and the Logistik trailer LT01 retreads, and Duramold tyres designed for a cross-section of heavy and light truck operations – the company showed its relatively recent evolution into more rounded service provision. In terms of its retreading activities, estimated by the company to account for just under a fifth of the UK market, the last year saw upgrades to the Lincolnshire business’ manufacturing, with a second 12-segment, high pressure (300psi) press installed, with which its Logistik brand products are produced, alongside further phases of its new conveyor system and other general upgrades designed to improve product flow, utilisation, productivity, efficiency, and housekeeping. Tyres & Accessories spoke with Vacu-Lug fleet sales director, Dave Alsop during the show, who explained how the company has reacted to the contraction of UK retreading and various other challenges in the market.

Comments