Russian market still Nokian’s largest, but its significance continues to shrink

Nokian Tyres' sales in Russia and the CIS

Nokian Tyres' sales in Russia and the CIS

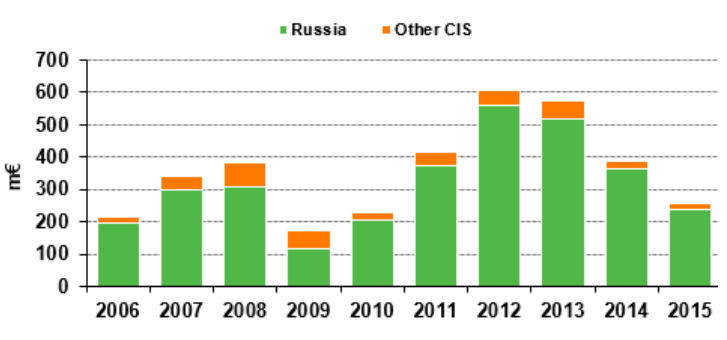

Russia has become Nokian Tyre’s problem child. Although the country is home to two tyre plants that service export markets and contribute to the company’s margins, sales of Nokian products in Russia and the CIS have more than halved within the space of four years. In 2015 alone, the region’s turnover fell by 34 per cent.

In 2012, the Finnish tyre maker was able to report that its “strong position in Russia” had “improved further.” Demand for its tyres increased by 50 per cent during the year, three times faster than the overall market, and Russia was deemed a “comparatively healthy” market that offered the company “a good base for profitable business.” That year, Nokian Tyres achieved a turnover of €606.7 million in Russia and the CIS, a figure representing 35 per cent of total company sales. Nokian Tyres’ 2012 Annual Report confidently stated that “the market for premium tyres is estimated to grow on the average by ten per cent yearly” in Russia.

By 2014, the Ukraine crisis and sanctions implemented by the US and Europe had thrown cold water over the Russian automotive sector. The rouble lost almost half its value against the US dollar during the year and more than a third of its worth against the euro. This currency weakness and resulting drop in purchasing power hammered Nokian’s top-line; consolidated sales in Russia and the CIS decreased 33.0 per cent €386.7 million, mainly due to the rouble’s weakening against the euro. The region accounted for just 25.5 per cent of Nokian Tyres’ total 2014 sales.

Russia’s economic situation remained challenging in 2015, with preliminary estimates showing GDP to have contracted 3.7 per cent year-on-year, while high inflation caused real wages to decrease in value by ten per cent. Purchasing power further weakened and consumer confidence remained low. Sales of new cars in Russia fell 35.7 per cent to 1.6 million units. Tyre market sell-in for the A and B segments (where Nokian is most active) is estimated to have declined by approximately 20 per cent during the year as consumers increasingly forsook these products for cheaper segments. Nokian Tyres remains the market leader in the A and B segments, however.

The tyre maker’s sales in Russia plummeted 34.8 per cent to €237.0 million, while CIS sales declined 22.0 per cent last year to €18.1 million. Turnover for the combined markets fell 34.0 per cent year-on-year to €255.1 million, less than half the peak 2012 figure. Sales in Russia and the CIS sank from 25.5 per cent of Nokian Tyres’ global sales to only 17.4 per cent.

Going forward, Nokian Tyres anticipates that sales of new cars in Russia will fall a further ten to 25 per cent in 2016. While the company will continue to be market leader in the A and B segments, the company expects an overall decrease in tyre demand this year, and a continuing shift in tyre sales towards the lower B and C segments.

The only good news in all this is Nokian Tyres’ manufacturing operation in Vsevolozhsk. The tyre maker states it “continues to have competitive advantages from having manufacturing inside Russia.” The rouble exchange rate that has eaten away at sales in this market makes production within Russia increasingly affordable – production costs are paid in roubles while export sales (67 per cent of Nokian’s Russian production was exported last year, mainly to Central Europe and North America) are paid for in euros and dollars, thereby supporting the company’s margins.

Comments